6 Important Stock Market Rule Changes Effective October 1, 2024

- Sunil Gurbaxani

- Sep 29, 2024

- 2 min read

As of October 1, 2024, several significant rule changes will come into effect in the Indian stock markets. These updates, ranging from tax changes to revised transaction fees, will impact how traders and investors engage with the market.

Let’s dive into the details: 1. STT (Securities Transaction Tax) Hike on F&O Transactions

The Securities Transaction Tax (STT) for Futures and Options will be increased, affecting the cost of executing trades in these segments:

- Futures: STT will rise from 0.0125% to 0.02%.

- Options: STT on the sale of options will increase from 0.0625% to 0.1% of the premium.

This change, aimed at addressing the growing derivatives market, will directly increase transaction costs for active traders.

2. New Buyback Tax Rules

The tax on share buybacks is set to shift from companies to shareholders. Previously, companies paid taxes on buybacks, but now shareholders will be required to declare their buyback income as capital gains. This change aligns buyback taxation with that of dividends.

3. Bonus Shares: Trading Allowed on Ex-Date

Investors can now trade bonus shares on the ex-date, which is typically two days before the record date. This update will enhance liquidity by allowing investors to sell their bonus shares immediately, rather than waiting until the record date.

4. IPO Guidelines: Enhanced Investor Protection

New guidelines have been introduced to make the Initial Public Offering (IPO) process more transparent. These changes are aimed at improving investor trust by mandating better communication and refund processes during IPO allotments.

5. TDS on Floating Rate Bonds

A new Tax Deducted at Source (TDS) of 10% will apply to interest income from floating-rate bonds. This change is expected to improve tax compliance in the bond market and may impact both retail and institutional investors who hold these fixed-income instruments.

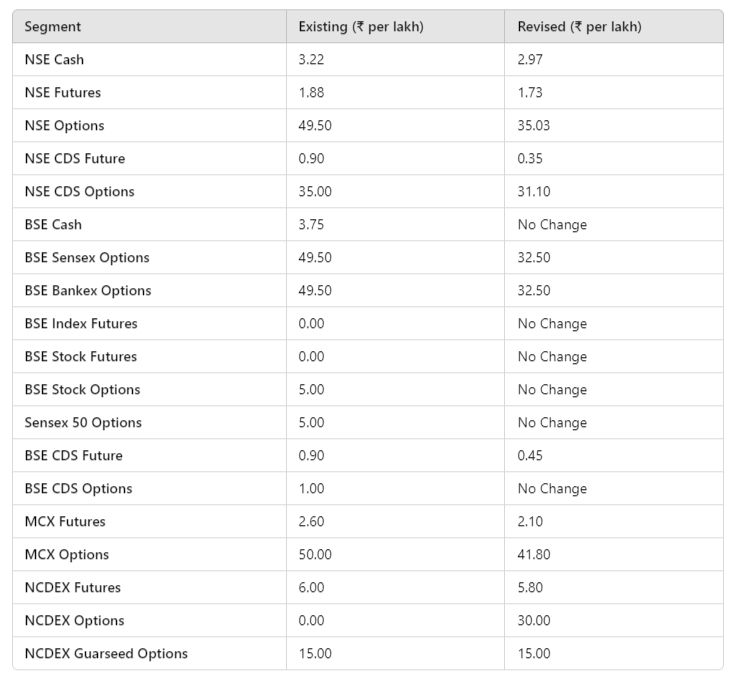

6. Revised Transaction Charges at NSE, BSE, MCX, and NCDEX

Starting October 1, 2024, significant changes will be made to the transaction charges on various segments across exchanges like NSE, BSE, MCX, and NCDEX. These changes will affect trading costs for both cash and derivative markets.

These revised charges will directly affect trading costs across segments. Active traders and institutional investors should carefully review these changes to understand how their trading expenses may be impacted. We also need to keep an eye on SEBI's upcoming board meeting scheduled for Monday, September 30, 2024, which will focus on revising regulations in the Futures and Options (F&O) market. The meeting aims to address the rapid rise in retail speculation, with retail participation in options trading growing from 2% to 41% in just six years. To curb substantial retail losses and ensure market stability, SEBI is expected to discuss key changes like increasing the minimum contract value to ₹15-20 lakh and potentially up to ₹30 lakh in the future. Additionally, they are considering reducing contract expiries to one per week per exchange and revisiting margin requirements for contracts nearing expiry to mitigate risks for retail traders.

These discussions are crucial as they aim to balance retail investor participation with market safety, promoting more informed trading practices

Comments